The Prospect of an Indo-Chinese Role in Reconstructing Christchurch

In an inversion of development norms, Rachit Ranjan & Ishita Das argue that christchurch could look to emerging markets to help it rebuild and prepare for the future.

The devastation unleashed by the earthquake in 2011 left Christchurch and the Canterbury region in New Zealand in utter socio-economic disarray. The earthquake caused widespread economic loss to the tune of 18 Billion Dollars. Conservative estimates suggest that the total cost of rebuilding the city, as envisaged, will cost nearly 40 billion Dollars. At a time when most governments across the world are grappling with fiscal deficits and sluggish economic growth, raising this nature of funding and creating a world-class city appears to be an insurmountable task. While 80% of the funding is expected to be covered by insurance companies, the remaining 20% presents a significant fundraising challenge for the body mandated with rebuilding the Canterbury region, the Canterbury Earthquake Recovery Authority (CERA).

While the CERA has identified some key players who would be able to support the initiative for building a city of the future, it can substantially address its challenges by looking into emerging markets both for investments and PPP projects. During a time when most of the western world is still experiencing the effects of a punctured economy, emerging markets continue to grow at a healthy rate (notwithstanding the ephemeral turbulences in the global market) and are investing heavily in overseas projects with the objective of expanding their global economic footprint.

India and China, in this context, emerge as the natural option as both countries have developed an aggressive foreign investment outlook with the objective of taking their respective industries global and satiating their economic growth appetite.

India

In an effort to integrate her economic ambitions with the global markets, India has been investing actively overseas for the past two decades. The last decade has seen a significant rise in India’s foreign investment owing to the development of a robust economic outlook geared towards enhancing the export competitiveness of Indian products and exploiting the domestic potential of the host country’s market. The figure below depicts India’s outward FDI trends. Also, the outward FDI was growing at a steady rate on account of easing of overseas investment norms by Reserve Bank of India, it experienced a period of decline since 2009. This decline can be credited to the global financial crisis, which had created a rather grim investment portfolio for many countries. As seen in the figure, India’s outward FDI is once again resurgent and as per the available data, the previous financial year has seen the largest outward flow of investments (although 19.1 billion Dollars has come in the form of guarantees). It may be added here that India is not the only country with a positive outward investment scenario. Many developing countries have been investing in a host of projects abroad in the form of equity, loan and guarantees. The available data suggests that the share of emerging economies in the outward FDI market rose from 1 trillion Dollars in 2001 to 4.1 trillion Dollars in 2011.

Fig. 1 Source: Careratings/RBI

Although New Zealand doesn’t figure in India’s outward FDI destinations yet, the market in New Zealand particularly the Christchurch redevelopment plan is in line with Indian strategies and criteria for investing abroad. A bulk of Indian investments is guided by the theory of market rationality. As per the EXIM Bank’s strategy the rationale for acquisition and investments relates to the following motives.

• Creating market access for products

• Cost-effective acquisition of skills and technology

• Forward integration of business ventures

• Saturation of Indian market

It would be interesting to explore these motives in conjunction with the sectoral distribution of investments and requirements for rebuilding Christchurch. India’s major investment came in the transport, storage and communication services sector followed by manufacturing (see Figure 2). As per the Christchurch Transport Strategic Plan, about 45% of the roads in Christchurch suffered massive damage during the earthquake. Going forward, the efforts of the New Zealand government will be devoted towards creating a resilient transport infrastructure, which also tackles issues of congestion and greenhouse emissions. There is a big opportunity here for New Zealand to tap into India’s transport sector, which may provide the necessary equipment required for meeting the needs of transport sector. Any transport sector looks into three major areas of functioning- infrastructure, movable assets and operations. India’s experience is found in the field of movable assets, particularly in providing equipment and services targeted toward reduction in operational costs and increased quality of services including communications and information technology services. In this regard, India’s expertise can be capitalized to provide Christchurch with low cost and high quality transport services commensurate with the vision of the Strategic Plan.

Fig.2 Source: Careratings

The challenging part in attracting this investment is convincing India to invest in New Zealand. This would necessarily be a mix of diplomacy coupled with business incentivisation. From a diplomatic standpoint, it would be beneficial for both countries to expedite the negotiations on the Free Trade Agreement, which will provide preferential access to the Indian services industries and allow the New Zealand dairy industry to tap into the India market, thereby generating significant export revenue. Further, from a business incentivisation perspective, if we look at India’s top outward investment flow, the destination countries such as Netherlands are small in size and do not have the sort of domestic market to necessitate the amount of investments made by Indian entities. However, these countries have provided an attractive taxation regime, which make it a favorable destination for onward routing of investments into third countries. Given this backdrop, New Zealand should look towards the tax benefits that it may be able to offer Indian businesses a lucrative market scenario with an option for forward integration and uninterrupted market access. To this extent, New Zealand must also consider two models of benefit delivery from investments as listed out by KPMG. This include Tax Incremental Financing, where borrowing is secured against increases in future rates from economic growth and the Earnback Model, where infrastructure borrowing is secured against future central tax gains.

China

China’s global footprint in terms of loans offered and investments has increased substantially in the last decade. Ever since the Go Global Strategy launched under the leadership of Deng Xiaping in 1999, Chinese investments have been increasing at a steady rate and faced minor turbulences during the global financial downturn. As of now, China is the third largest FDI provider to the world with its investments spreading to 184 countries. Econometric analysis literature suggests that a majority of China’s investments are directed towards countries, which have abundant natural resources and poor institutions (perhaps because this would give them some flexibility to maneuver local laws). However, data also suggests that investments are made in bulk to tax havens such as Cayman Islands and British Virgin Islands, mostly for the purpose of onward routing of such investments. In terms of regional flow, the dominant flow is towards Latin America, Asia and North America.

Fig.3 Source: World Bank

Currently China figures as the second largest trading partner for New Zealand. China is the main destination for New Zealand’s export market, where it garnered export revenue of 9.9 billion NZ Dollars as of December 2013. Although the Free Trade Agreement executed between the two countries has allowed the establishment of a healthy trading relationship between them, China’s investment in New Zealand have been marginal. This is also reflective of the general trend of inward FDI in New Zealand, which has experienced a significant decline. From 4.1 Billion Dollars in 2011, FDI in New Zealand dropped to 987 million dollars in 2011.

Fig.4 Source: MOFCOM & UNCTAD

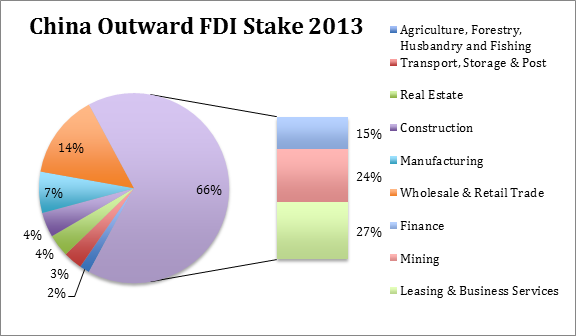

The sectoral distribution figure indicates that China prefers to route a significant chunk of its outward investments in the “Leasing & Business Services Sector”. Studies have shown that a large amount of investments under this category are routed towards the mining sector. The mining sector itself is the second largest target for outward investments and includes “oil and gas” sector within it.

While, New Zealand is not plagued by the presence of poor governance institutions, it is certainly endowed with abundant natural resources. Particularly in the “Oil and Gas” sector, New Zealand holds immense potential. To date, much of the drilling take place in the Taranaki Basin with total production averaging around 130,000 boe/d. The East Coast Basin has experienced limited exploration but has significant resource potential with more that 300 known oil and gas seeps and many wells have shown oil and natural gas indications during the process of drilling. While there has been no production in the region thus far, foreign investment in the form of new technology can be utilized to explore prospecting and extraction opportunities especially in the vast shale beds. The prospect for investment is further enhanced by the fact that New Zealand now has access to 5.7 million square km of ocean and seabed, which contains 18 known sedimentary basins.

A recent survey by FIAS/IFC/MIGA indicated that several countries were not preferred for outward investment due to lack of knowledge about local laws and regulations thereby making them a “political risk.” It must be added that New Zealand figures in the list of countries with a high “Political Risk” as per the survey. Although, the Chinese government is forthright in offering assistance to Chinese entities looking to invest overseas, there is possibly a need for greater cohesion of interests and knowledge sharing between the host country and China. To this extent, the onus falls upon New Zealand to establish a deeper channel of communication with Chinese embassies apprising them of the benefits of investing in New Zealand. It is readily arguable, that there is a great opportunity in the offing for aligning the interests of these two nations, through which significant revenue can be generated for rebuilding Christchurch in particular and developing New Zealand’s economic outlook in general.

As mentioned in the KPMG report, Sovereign Wealth Funds are becoming one of the primary tools for inviting foreign investments. China has the largest deposits in the world in its Sovereign Wealth Fund. SWFs in China and Singapore have been actively involved in investments in overseas infrastructure projects. For example, in 2011, China Investment Corporation (CIC) bought a 25% stake in Shanduka Groupe (South Africa) for $250 million. Assets under management of more than 70 major SWFs, based in countries around the world, approached nearly $6.4 trillion according to a recent UNCTAD Report. Therefore SWFs from countries such as China represent enormous potential and capacity to meet the funding shortages of the Christchurch rebuild process. The infrastructure-funding gap can further be met through private individual investments. As per the report of the Boston Consulting Group, China’s private wealth reached 22 trillion Dollars in the last year and is slated to grow to 40 trillion Dollars by 2018. As China is investing a lot with the intention of promoting the international use of Yuan, it has eased restrictions for its nationals to invest in overseas property and stocks through a domestic retail scheme. Considering the presence of a sizeable Chinese diaspora in New Zealand, capital flows into the housing market in the country from Chinese citizens is pegged to rise by 8%. To this extent, if New Zealand manages adequate policy responses, which keep in mind the socio-economic welfare of its citizens, capital inflow from private Chinese citizens may provide steady funding for housing projects that have been envisaged for Christchurch.

It must be added here that as an additional strategy for inviting revenue New Zealand should project and develop its education industry into a world- class system, which will attract students from both India and China in big numbers. The emerging markets such as India and China are very important sources for meeting New Zealand’s skilled labor force shortage with regard to the Christchurch rebuild. China is the largest source of international students in New Zealand with India being the fourth largest source in 2010 (See Figure Below).

Fig.5 Source: www.minedu.govt.nz

If the education market in these two economies is tapped into, with specific focus on imparting Christchurch rebuilding skills, it will not only bring in revenue for New Zealand but can also generate a huge influx of skilled labor with a greater retention potential.

The New Development and Infrastructure Banks

The emergence of the BRICS block presents a significant opportunity for New Zealand to secure funding for her infrastructure projects targeted at rebuilding Christchurch. The New Development Bank will have a capital of 100 billion Dollars and will primarily focus on lending for infrastructure projects with an authorization to lend 34 billion Dollars annually. New Zealand may also look towards seeking funding from national development banks such as China Development Banks, whose recent investment trends show that it prefers mature markets due to the presence open competition and established practice for PPP projects available in such markets.

The infrastructure funding opportunity is further enhanced by the advent of the Asia Infrastructure and Investment Bank, which has been proposed specifically for meeting the infrastructure development demands required for the economic development of the region. Thus both new and existing banks hold immense potential for meeting CERA’s affordability gap.

Concluding Remarks

The aforementioned analysis signifies that in light of the after shocks of the global financial crisis in the developed world, New Zealand must re-think its development strategy and make a concerted effort towards consolidating ties with countries such as India and China, which can not only provide substantial support for rebuilding Christchurch but also towards the larger socio-economic development of the country. It would be prudent for New Zealand to explore the investment benefits that can be offered to investors from such countries and increase bilateral cooperation to inform prospective investors about local laws and regulations with the objective of facilitating foreign trade and investment.

The authors are associated with the Oval Observer Foundation. The views presented in this article do not necessarily reflect the views of the Foundations, its partners and affiliates.

Photo credit: martinluff / Foter / CC BY-SA