Do Economists change the Financial System, or does the Financial System change Economists?

How does received knowledge vis-a-vis our financial system emerge and change? Here, Michael Lee explores how ideas about the economy have come into existence and gained acceptance in contemporary UK and US economic thinking.

Imagine a world where Milton Friedman received more encouragement in art, and less in math as a child. Young Milton might have become an artist instead of an economist – titillating the art world with absurdist depictions of “free lunches”. Without Friedman the economist, wealthy collectors would rush to buy a “Friedman” to hedge against inflation, while grumbling about the latest tax hike. Then again, perhaps neoliberalism would have slain Keynesianism anyway. The same economic crises, the same governments, and the same structural forces would have been in operation in either case. For instance, Friedman (and Anna Schwartz’s) highly influential Monetary History of the United States was published as part of a National Bureau of Economic Research series on business cycles. Even absent Friedman NBER might still be looking for similar work. Are broad-based changes in economic policy driven more by the pure advance of ideas, by material and structural changes, or by something in-between?

I want to answer the ideational-material question in the context of British and American financial regulation. Recent years have seen considerable changes to financial regulation – Dodd-Frank in the United States, and the Financial Services Act in the United Kingdom imposed tougher rules, while President-elect Trump has called for looser ones. The way banks and securities markets are regulated is immensely important. Not only can regulation influence the likelihood of financial crises, it can also determine the flow of capital to downstream industries. Insofar as financial regulation influences which firms get capital and which do not, it can be thought of as the constitution for the economy. The tendency is for financial reform to follow a punctuated equilibrium pattern – once a regulatory order is entrenched, it can last for decades (e.g. the Glass-Steagall system enacted in the United States in 1934).

Understanding what drives financial deregulation and regulation is tricky. Some works play up the role of ideas. It’s possible to view history as a pendulum wherein ideas swing from laissez-faire to interventionist. Perhaps regulation and deregulation largely tracks the pendulum. In test this idea; I opted to measure the pendulum, using relative references to economists in Google’s sample of books, the UK Hansard and US Congressional Hearings since 1846. Figure 1 indicates whether the ideational pendulum favored markets (+1), opposed them (-1) or lay somewhere in-between.

Figure 1: The prominence of pro-market ideas, 1846-2007 (5-year moving average)

A second group of works tends to stress material factors as drivers of economic reform. One possibility is that the financial sector tends to favor weaker regulations than the general public. If true, we should expect weaker regulations to prevail in periods when the financial sector is relatively powerful. Perhaps regulation increases after financial crises? As early as 1720, the British government passed the Bubble Act to slow the proliferation of dubious companies amidst the South Sea Bubble. Yet it is also possible that different crises garner different reactions. Some finance-heavy crises, like the Great Depression, eviscerate the banks, and with them, the main opponents of regulation. In contrast, finance-light crises like the 1890 Barings crisis largely spared the financial sector while eviscerating Main Street. Global competition, too, may push regulations downward as countries compete to enhance their viability as global financial centers. When CFTC Chair, Brooksley Born tried to rein in derivatives markets in 1998, she was firmly rebuked by Fed Chair Alan Greenspan, who argued that regulation would merely send the derivative market to London. Finally, market-friendly governments may tend to deregulate, while less free market oriented ones prefer stringent regulations.

Unfortunately, ideational and material explanations tend to be placed in opposition to one another, when in fact it is likely they interact. When economists choose research questions they are influenced by what the NSF or the NBER is interested in. I study financial crises largely part because I was in graduate school in 2009. To try to resolve this dilemma, I ran a regression of regulation on material and ideational factors, using a VECM model, which makes few assumptions about which variables impact which other variables.

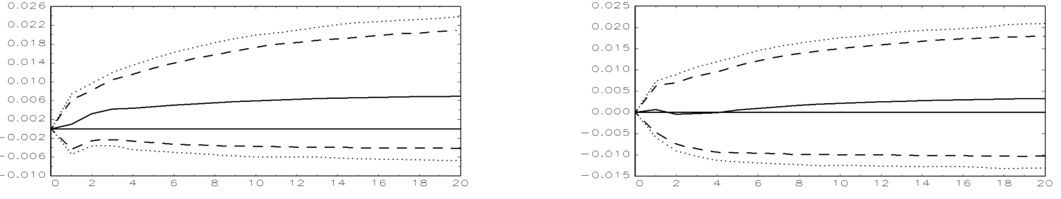

In Britain, financial regulation tended to respond to ideational change among elites (change in the composition of books flirted with weak statistical significance). When economic ideas grew more market-friendly, regulations fell.

More market-friendly books (UK) More market-friendly Hansard

In contrast, in the United States, the rising stock of pro-market economic ideas, whether in google books, or in congressional hearings had no statistically significant impact on regulatory stringency.

More market-friendly books (US) More market-friendly Hearings

Rather, the UK and the US exhibited sensitivity to different material factors. UK regulations fell when British finance faced competitive challenges abroad and the relative importance of finance as a percent of GDP. In contrast, American regulation tended to rise after crises, and when left-leaning governments controlled the presidency, Senate and House. One interpretation is that the near-constant political campaign that defines American politics (e.g. 2-year terms in congress) makes it harder for politicians to wait out a crisis. In contrast, British governments can delay reform till after the worst effects of a financial crisis had subsided (the 2011 Fixed Elections act may circumscribe this ability). The relative speed of the passage of Dodd-Frank, compared to the Financial Services Act is a useful case-in-point. Theresa May’s ability to delay invocation of Article 50 would be another, albeit in a different policy arena.

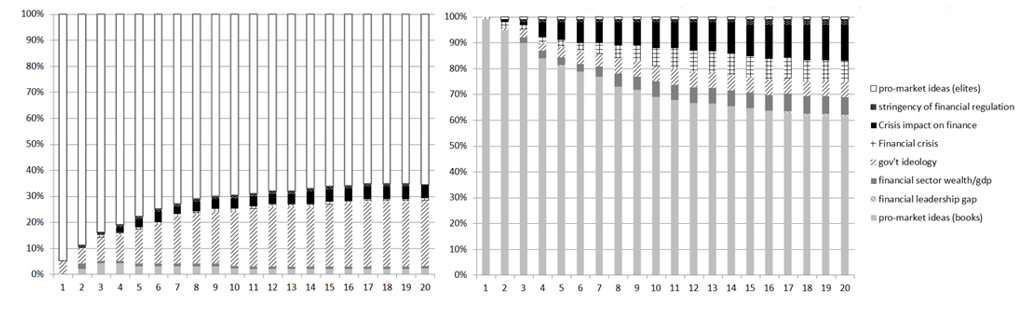

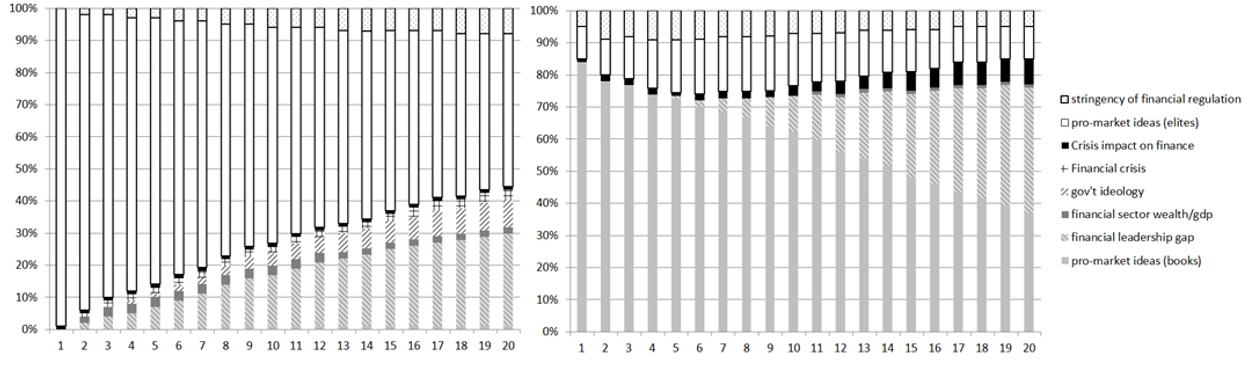

Although ideas (apart from elite ideas in Britain) had little impact on financial regulatory policy, I found considerable evidence that there are distinct idea-generating processes in Britain and the United States. Moreover, elites and broader shifts tend to be driven by different things. In Britain, changes in government ideology had the biggest impact on elite ideas. In contrast, the public debate was more responsive to crises. “Animal spirits” probably felt a little more plausible in 2008.

Economic Ideas (Parliament) Economic Ideas (books)

In the United States, shifts in competitiveness appeared more likely to trigger ideational shifts, both among elites and in the large sample of books. Interestingly, many of the factors that tended to drive ideational change in either sphere were often those that didn’t result in policy change.

Economic Ideas (Congress) Economic Ideas (books)

So, what can one take away from this research? “Great man” theories of idea-driven changes and broad ideational shifts probably do not explain changes in financial regulatory policy. Ideational shifts among elites do a much better job, and even then, their impact may depend on institutions. When we treat economic ideas as manna from heaven, we ignore the ways in which their production can be influenced by crises, or the job opportunities afforded to economists by a booming financial sector.

Michael Lee is Assistant Professor in the Department of Political Science, Hunter College, the City University of New York. This post first appeared on the LSE's British Policy and Politics blog.

Photo credit: jaci XIII via Foter.com / CC BY-NC-SA