Using Global Taxation to Foster Global Citizenship

The global minimum corporate tax, coming into place in 2023, is a first step toward a global system of taxation, but it will benefit almost exclusively rich countries. I recommend that half of the tax revenues be devoted to a Global Social Fund to empower people and to provide an automatic safety net starting with the poorest of the poor.

The need for a global safety net

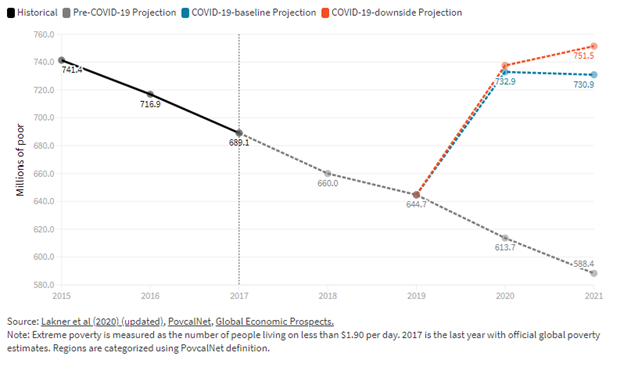

The spread of the COVID-19 pandemic has underlined the crucial importance of safety nets. The World Bank (2021) estimates that more than 100 million people have become poor as an effect of the pandemic, adding to 600 million already in poverty. This shift has reverted a trend of decreasing poverty spanning several decades (Figure 1). Levels of social exclusion, as measured by the Bertelsmann Transformation Index, reached an unprecedented high in 2021, hitting low-income countries particularly hard.

Social cohesion measures are typically conceptualized and implemented at the national level. Nonetheless, the gravity of the crises lying ahead of us– be they of health, environmental, or security nature –and the interconnectedness of societies around the world make this approach insufficient. While high-income countries can finance safety nets through public debt, middle and low-income countries lack the “fiscal space” to do so.

Constructing safety nets at the global level can be defended not only on ethical grounds but also on efficiency grounds. A debt crisis is looming for low and middle-income countries lacking adequate financial resources to contrast growing fiscal deficits. Financial instability will ultimately hurt high-income as well as low-income countries. Bottlenecks in supply chains and price increases are partly the consequences of portions of the workforce being put idle to comply with quarantine requirements. According to a macroeconomics study, a “rich-nation-first” approach to COVID-19 vaccinations, as opposed to one providing vaccines equitably worldwide, caused a 3% reduction in world GDP, half of this cost falling on advanced economies. The establishment of a global safety net would limit such costs.

Figure 1: The impact of Covid-19 on global extreme poverty

Using revenues from the corporate minimum tax to fund a global Citizenship Fund

On the 4th of November 2021, 137 countries and jurisdictions - accounting for over 90% of the global economy - signed an accord aimed at ensuring that large multinational companies pay a minimum tax rate of 15%. The Global Minimum Corporate Tax (GMCT) would apply to overseas profits of multinational firms with more than 750 million euros in sales globally. The accord calls for national governments to “top up” their corporate taxes to the 15% minimum whenever a company is taxed at a lower rate in another country. For instance, if a company from the US opened a subsidiary in a tax haven to pay its taxes there, the US tax authority could levy a tax at a rate equal to the difference between 15% and the tax rate applied in the tax haven. This system should eliminate the advantage of shifting profits to tax havens and halt the “race-to-the-bottom” in corporate taxation that has taken place since the 1980s. A second part of the accord allows countries where revenues are earned to tax 25% of the largest multinationals' so-called excess profit, i.e., profit in excess of 10% of revenues. This legislation should come into effect in 2023. The OECD forecasts that such a deal will yield $150 billion per year in increased taxation, most of which will accrue to G7 countries. This deal has been hailed as a historic step forward in global tax cooperation, although many lamented that a 15% tax rate is way too low a rate for it to be considered fair and effective.

In a policy brief developed for the ThinkTank7 network, I have recommended G7 countries to devote half of the additional tax revenues stemming from the GMCT to a Global Citizen Fund, administered by a newly created agency in collaboration with the United Nations. The main goal of the Global Citizen Fund is to set the foundations for a global safety net that guarantee a minimum level of wellbeing to every person in the world, and makes sure that none is left behind, especially in times of crisis such as the COVID-19 pandemic. More concretely, I propose the Global Citizen Fund to be allocated to the payment of a Global Citizen Income (GCI) worldwide. A Citizen Income (also often called universal basic income) is a periodic cash payment unconditionally delivered to all, on an individual basis, without means-test or work requirement . A Global Citizen Income is a Citizen Income extended to all citizens of the world. A Citizen Income is a way to fulfil the widely shared idea that no one should be left without the means to live a dignified life, acknowledging that every human has an entitlement to receive a dividend from the exploitation of natural resources and inherited infrastructures. It can also be justified as compensation from high carbon-emitting countries to low-carbon emitters, as well as on other economic, political and social arguments.

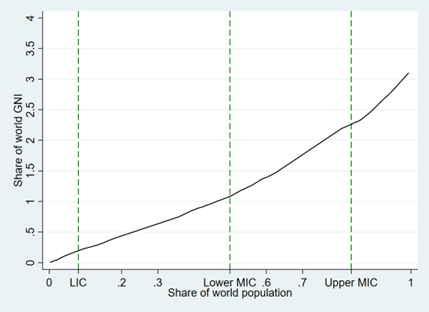

Figure 2 reports the financial resources that would be needed (expressed as share of world Gross National Income) to hand out a daily sum of $1.90 (adjusted for Purchasing-Power-Parity, PPP) in relation to the share of the world population. A sum of 75bn is equivalent to approximately 0.1% of world GNI and would enable to pay a PPP-$1.90 to approximately 260 million poor people worldwide, equivalent to 3.5% of the world population. Since the World Bank estimates that around 750 million people fall below the poverty threshold of PPP-$1.90 in 2021 (Figure 1), dedicating half of the revenues from the GMCT to the Global Citizen Fund would enable about a third of the world poor to be brought out of poverty (omitting administrative and implementation costs).

Figure 2: The Figure plots the relationship between the share of world Gross National Income (GNI) required to pay a PPP-$1.90 cash transfer (y-axis) and the shares of the world population that would be covered by the transfer (x-axis). Covering the whole world population would require approximately 3.1% of world GNI. LIC, Lower MIC and Upper MIC denote population shares for Low-Income Countries (LIC), Lower Middle-income Countries (MIC) and Upper Middle-Income Countries. Author elaboration based on data from World Bank national accounts (https://data.worldbank.org/)

Cash transfers are made possible even in low-income countries thanks to the diffusion of mobile money. Beneficial effects of cash transfers have been found on a broad variety of outcomes, such as monetary poverty, education, health, nutrition, savings, employment and empowerment. The fear that money transferred to the poor will end up in “temptation goods”, e.g. alcohol and tobacco, – appears unfounded. On the contrary, universal cash transfer recipients seem eager to use the transfers on beneficial activities, such as paying off their debts. Cash transfers have been used extensively to combat the COVID-19 crisis, thus proving the suitability of this instrument in crisis situations.

Other lines of funding to further increase the coverage of the Global Citizen Income may come from international aid, especially if countries comply with the UN target of allocating 0.70% of GNI to Official Development Assistance (against the current level of 0.30%). Other taxes on multinational corporations, such as a 0.02% tax on the stock value of large corporations, may be levied (yielding about $180bn in revenues). Approximately $200bn may be recovered by eliminating loopholes permitting individuals to store their wealth in tax havens.

Additional sources of global taxation are explored in another policy brief. Landais, Saez, and Zucman proposed a progressive wealth tax taxing the millionaires at 2% and billionaires at 3% per year, which would have risen around 3.3% of world GDP in tax revenues. A global system of carbon taxation could raise around $1.6tn per year in this decade. Taxing financial transactions worldwide (the so-called Tobin Tax), at the modest rate of 0.1% would generate around 7% of the world GDP as revenue – even assuming that half of the tax base would be lost, due to either avoidance or evasion.

This set of taxes would be progressive in character and would yield an overall financial capacity of around 12% of world GNI. This would permit the payment of a GCI of PPP-$3.2 to everyone in the world – at a cost of $4.25 trillion, or approximately 5.22% of world GNI. The fiscal capacity collected in excess of this target could then be used for the provision of other global public goods, to further strengthen social protection on a global basis, to provide investment for mitigation and adaptation to climate change, to increase preparedness for future pandemics , and to support the Sustainable Development Goals.

In a time of war and receding globalization, talking about expanding global social cohesion may sound utopian. Nevertheless, it is precisely at times of crisis that social change can be expected to come about. Research in social psychology tells us that a sense of “shared fate” is a powerful element to foster group identity. Although nationalism seems resurgent worldwide, one cannot discard the idea that a sense of global citizenship may, perhaps against all odds, be fostered in the near future by the urgency of the global challenges lying ahead. A partial confirmation of this conjecture comes from research showing that inter-personal trust has marginally increased under the pandemic, although prosocial attitudes had mainly a parochial character.

A shared sense of global identity can be forged especially if people realize not just the costs, but also the benefits of global cooperation. In the words of UN Secretary General Guterres, global challenges such as the pandemics should make us realize that we are only as strong as the weakest among us. The Global Social Fund may be a powerful instrument to further foster such a sense of global citizenship.

Gianluca Grimalda is senior researcher at the Kiel Institute for the World Economy and member of the steering committee of the International Panel on Social Progress. Twitter: @GGrimalda

Photo by Cup of Couple