Oil Avarice vs Climate Action: the Ultimate Collective Action Problem

Martha Molfetas argues that governments continue to pick up the bill for the fossil fuel industry's destructive greed.

It’s not new news, fossil interests continue to stymie climate progress. We saw this unfold with dramatic flair at COP28 in Dubai. Posturing against the inevitable renewable energy transition continued at CERAWeek, where oil and gas interests parroted the same tired refrains of fossils forever while undercutting the inevitable renewable energy transition. The cause of 75% of all global emissions and 90% of all carbon dioxide emissions continues to stand in the way of progress.

Meanwhile the place we all call home is at risk; 2023 broke all climate records. We are potentially already in a 1.5°C world with ocean systems showing signs of deterioration. There is not a big enough alarm bell to ring. We need to switch off fossils and turn on renewables now. Continuing to bolster fossils is anathema to our climate crisis—the ultimate collective action problem.

Leave no Stranded Asset Behind

The approach continues to be ‘drill it all’—at least this is the signal Shell, Saudi Aramco, and other fossil interests have projected by way of weakening and reneging against emissions reductions, increasing oil outputs, subverting climate action via misinformation campaigns, and actively lobbying against climate action whenever possible.

At CERAWeek, Saudi Aramco’s CEO made many claims touting the clean energy transition as a failure and the need to push for more fossils. Shell weakened their carbon reduction goals for 2030 across scope 1, 2, and 3 emissions categories. This is all in addition to the fact that more oil companies were represented at our last climate conference than all but two country delegations; and that fossil funded campaigns are attempting to subvert clean energy alternatives via funding think tanks and misinformation campaigns—old habits die hard.

Meanwhile, methane emissions from fossils are at an all time high despite industry pledges. The extraction and burning of fossils is not happening in a vacuum. Increasingly, we need to view these resources as stranded assets—this is any asset that has been devalued or is considered a liability. This means fossil reserves ought to be considered climate liabilities. Sixty-percent of known oil and gas reserves need to remain unextracted to avert the worst consequences of climate change. The push to extract more by fossil interests should be off the table based on the inherent climate risks it will cause for us all.

The Ultimate Collective Action Problem

Long gone are the days we could turn a blind eye to the climate impacts and risks fuelled by fossils. Governments, financial institutions, and insurers can no longer ignore the elephant in the room—continuing to exploit and support the development of fossil fuels will leave us all worse off: increase risks to lives and livelihoods, make many homes uninsurable, increase migration, and create a world unimaginable from that of our present.

Our climate crisis is the ultimate collective action problem. Everyone knows change has to happen, but those responsible see limited reasons to alter course. In the end we all suffer the consequences. The greed of a single industry is overwhelmingly fuelling our climate reality.

The problem is corporations are operating with the past as prologue. When industries behave badly, governments have swooped in to pay for damages. High risks yield high rewards and limited responsibility for damages. We’ve seen this after oil spills and with orphaned wells across the U.S. on the oil front. But we’ve also seen this play out for large financial institutions who were responsible for the housing crisis and recession in 2008 via predatory home loans. Cutting corners and pushing ahead with risky bets get paid off by taxpayers in the end—so why not take more risks? This mentality will leave us all worse off.

Paying for climate consequences has already begun. The U.S. saw 28 different billion-dollar climate and weather events in 2023—increasing frequency and costs from decades past. Europe is warming faster than any continent and is anticipating $1 trillion in damages; with over $50 billion in economic damages in 2022 alone. Globally, it’s estimated that climate related events cost us a collective $391 million each day.

This is all in addition to the $7 trillion in global fossil fuel subsidies governments pay out annually. As we continue to fund our own demise with public monies and face the consequences and risks of a climate changed world; it’s unlikely governments can afford to pay for the climate impacts of a worst case scenario. A business as usual approach is estimated to cost us all $1.26 quadrillion in damages by 2100— that’s roughly 12-times today’s total global market capital. Not to mention the upending of lives and the toll on livelihood resources.

But the transition to netzero could create 14-million new jobs by 2030, add $43 trillion to the global economy by 2070, and avert these worst consequences. The time for kicking the can down the road is over. What is happening at high level stakeholder forums and within fossil fuel boardrooms continues to be divorced from our climate reality and this historic moment. We cannot afford to lose time by acquiescing to fossil interests despite our own collective ability to live in a habitable world. There are no bailouts on a dying planet.

Martha Molfetas is a Senior Fellow, Planetary Politics, at New America - working on just energy transition; and a Visiting Assistant Professor at Pratt Institute’s Graduate Center for Planning and the Environment; where she teaches Environmental Economics. Martha is a senior climate and energy policy consultant, writer, and strategist with over 15-years of experience helping NGOs, think tanks, and businesses unpack climate, environmental justice, conflict, sustainable development, and global policy issues.

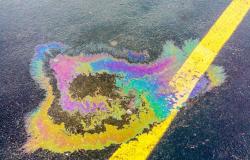

Photo by Dave Morgan